UUM BEEB 1013 Principles of Economics

Chapter 20: Introduction to Macroeconomics

20.1 Macroeconomic

Concerns

Output Growth

1) Business cycle (Kitaran Perniagaan / 经济循环) : The cycle of short-term

ups and downs in the economy.

2) Aggregate output (Keluaran agregat / 总合产量) : The total quantity of goods

and services produced in an economy

in a given period.

Figure 1: A Typical Business Cycle

1. Expansion or boom (Pengembangan ekonomi / 经济繁荣期): The period in the

business cycle from a trough up to a peak during which output

and employment grow.

Example: The economy is expanding as it moves through point A

from the trough to the peak.

2. Recession / Contraction / Slump (Kemerosotan

ekonomi / 经济衰退期): A period during which aggregate output declines.

Conventionally, a period in which aggregate output declines for two consecutive

quarters. The period in the business cycle from

a peak down to a trough during

which output and employment fall.

Example: The economy is in recession when it moves through point B from

a peak down to a trough.

3.

Depression (Kemelesetan ekonomi / 经济萧条期): A prolonged and deep

recession

Example: The economy is

in depression when it is at trough point.

4. Recovery (Pemulihan ekonomi / 经济复苏期): The period in the business

cycle from a trough up to a peak during

which output and employment grow again

Example:

The economy is in recovery when it raises up again from the trough to the peak.

Economy in Reality (US Economy)

Figure 2: U.S. Aggregate Output (Real GDP), 1900–2009

Unemployment

1) Unemployment rate:

The percentage of the labor force that is unemployed.

Kadar pengangguran 失业率: Satu ukuran yang menunjukkan peratusan jumlah tenaga buruh yang tidak melakukan sebarang kegiatan

ekonomi berbanding dengan jumlah tenaga buruh di pasaran.

Inflation and

Deflation

1) Inflation: An increase in

the overall price level of goods and services.

Inflasi

通货膨胀: Satu keadaan yang menunjukkan kenaikan tingkat harga umum barang dan perkhidmatan secara berterusan.

2) Hyperinflation: A

period of very rapid increases in the overall price level of goods and services.

Hiperinflasi

恶性通货膨胀: Satu proses kenaikan tingkat harga umum barang dan perkhidmatan secara

berterusan dan melampau pada kadar yang sangat

tinggi (> 10%).

3) Deflation: A decrease in

the overall price level of goods and services.

Deflasi

通货紧缩:Satu

proses penurunan tingkat harga umum barang dan perkhidmatan secara berterusan.

20.2 The

Components of the Macroeconomy

To see the big

picture, it is helpful to divide the participants in the economy into four

broad groups:

(1)

Households (Isi Rumah / 家庭成员)

(2)

Firms (Firma / 商家)

(3)

The government (Kerajaan / 政府)

(4)

The rest of the world (Sektor Luar Negara / 外国机构)

Households and

firms make up the private sector, the government is the public sector, and the

rest of the world is the foreign sector.

The Circular

Flow Diagram

1) Circular flow: A diagram showing the income

received and payments made by

each sector of the economy.

2) Transfer payments: Cash

payments

made by the government to people who do not supply goods, services, or labor in exchange for these payments. They include social security

benefits, veterans’ benefits, and welfare payments.

Circular flow

(English version) :

Figure

3: Circular Flow Diagram 1

·

Households receive income from firms and the government, purchase goods

and services from firms, and pay taxes to the government.

·

They also purchase foreign-made goods and services (imports).

·

Firms receive payments from households and the government for goods and

services; they pay wages, dividends, interest, and rents to households and

taxes to the government.

·

The government receives taxes from firms and households, pays firms and

households for goods and services—including wages to government workers—and

pays interest and transfers to households.

·

Finally, people in other countries purchase goods and services produced

domestically (exports).

Note: Although not shown in this diagram, firms and governments also purchase

imports.

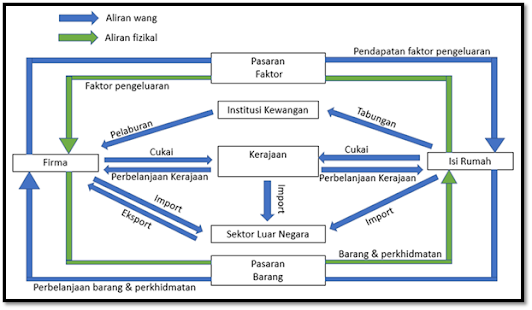

Circular flow (Malay

version) :

Figure

4: Circular Flow Diagram 2

1) Isi Rumah (家庭成员)

·

Menerima pendapatan dalam bentuk upah, sewa, kadar bunga atau untung

daripada firma dan kerajaan

·

Membelanjakan pendapatannya untuk membeli barang dan perkhidmatan yang

dikeluarkan oleh firma

·

Menabung baki pendapatan yang tidak dibelanjakan di institusi kewangan

·

Membayar cukai (seperti cukai pendapatan perseorangan) kepada kerajaan

·

Mengimport barang dan perkhidmatan dari luar negara

2) Firma (商家)

·

Membayar pendapatan faktor kepada isi rumah atas penggunaan faktor

pengeluarannya

·

Memperoleh pendapatan / hasil jualan daripada isi rumah dan kerajaan

·

Membayar cukai (seperti cukai keuntungan syarikat) kepada kerajaan

·

Membuat pinjaman dan pelaburan daripada institusi kewangan

·

Mengimport barang modal, barang perantaraan dan bahan mentah dari luar

negara

·

Mengeksport barang dan perkhidmatan ke luar negara

3) Kerajaan(政府)

·

Memungut cukai pendapatan perseorangan daripada isi rumah dan cukai

keuntungan syarikat daripada firma

·

Melakukan perbelanjaan kerajaan (seperti membeli barang dan perkhidmatan

yang dikeluarkan oleh firma dan memberikan bayaran pindahan dan subsidi kepada

isi rumah)

·

Mengimport barang modal dan kelengkapan pertahanan awam dari luar negara

The Major Economic Goals

1) Price Stability (Kestabilan tingkat harga umum 市场价钱稳定)

We need to understand how to measure prices to control

price stability to avoid inflation issue

2) Low Unemployment (Kadar pengangguran yang rendah 低失业率)

We need to know how to measure unemployment

3) High and Sustained Economic Growth (Meningkatkan

pertumbuhan ekonomi 提升经济成长率)

We need to know how to measure economic growth – which

takes us to a discussion of nominal GDP and Real GDP

U may refer the previous notes in malay version:

https://jlcy2020.blogspot.com/2020/04/bab-1-pengenalan-kepada-makroekonomi.html?m=1

The Three

Market Arenas

1) Another way of

looking at the way households, firms, the government, and the rest of the world

relate to one another is to consider the markets in which they interact.

2) We divide the

markets into three broad arenas:

(1)

The goods-and-services market.

(2)

The labor market.

(3)

The money (financial) market.

Goods-and-Services

Market

·

Households and

the government purchase goods and services from

firms in the goods-and-services

market.

·

Firms purchase goods and services from each other and also

supply to the goods-and-services market.

·

Households,

the government, and firms demand from

this market.

·

The rest of the world buys from and sells to the

goods-and-services market.

Labor Market

·

In

the labor market, households supply labor

and firms and the government demand labor.

·

Labor

is also supplied to and demanded from the

rest of the world.

Money Market

·

Households supply funds to the money market—sometimes called the financial market—in the

expectation of earning income in the form of dividends on stocks and interest

on bonds.

·

Households

also demand (borrow) funds from this market to finance various purchases.

·

Firms borrow to build new facilities in the hope of earning more in the future.

·

The government borrows by issuing bonds.

·

The rest of the world borrows from and lends to

the money market.

·

Much

of this borrowing and lending is coordinated by financial institutions, which

take deposits from one group and lend them to others.

Monetary Terms

·

Treasury bonds, notes, and bills: Promissory notes issued by the federal government

when it borrows money.

Bil-bil perbendaharaan

dan bon kerajaan: Nota janji atau sekuriti hutang yang

dikeluarkan oleh kerajaan pusat

apabila mereka ingin meminjam wang.

·

Corporate bonds:

Promissory notes issued by firms

when they borrow money.

Bon korporat:

Nota janji atau sekuriti yang

dikeluarkan oleh firma semasa mereka meminjam wang.

·

Shares of stock:

Financial instruments that give to

the holder a share in the firm’s ownership and therefore the

right to share in the firm’s profits.

Saham:

Sekuriti yang mewakili sebahagian modal pemilik dalam perniagaan dan pemegang saham juga

merupakan pemilik perniagaan dan mempunyai hak

untuk berkongsi keuntungan atau kerugian sesebuah perniagaan.

·

Dividends:

The portion of a firm’s profits that the firm pays

out each period to its shareholders.

Dividen:

Bahagian keuntungan syarikat yang dibayar

oleh syarikat kepada pemegang sahamnya pada setiap tempoh.

The Role of

the Government in the Macroeconomy

1) Fiscal policy (财政政策):

Government policies concerning taxes and

spending.

Dasar

fiskal: Tindakan kerajaan mengubah perbelanjaan

kerajaan dan cukai untuk menstabilkan

keadaan ekonomi negara.

2) Monetary policy (货币政策): The tools used by the

Federal Reserve to control the short-term

interest rate.

Dasar

kewangan: Tindakan bank pusat mengawal penawaran wang dan kadar bunga dalam ekonomi untuk menstabilkan keadaan ekonomi

negara.

20.3 A Brief

History of Macroeconomics in US

1) Great Depression: The period of severe economic contraction and high

unemployment that began in 1929 and continued throughout the 1930s.

2) fine-tuning: The phrase used by Walter Heller to refer to the

government’s role in regulating inflation and unemployment.

3) stagflation: A situation of both high inflation and high

unemployment.